Product launch

Value of Struggles

Value of Struggles

Struggles are catalysts for development.

The intense nature of launches exposes weaknesses of teams and areas requiring improvement. This the constructive outlook, at least.

Collaborations Among Stakeholders

Collaborations Among Stakeholders

How can us market access professionals (strategists, writers, editors, and everyone else) possibly do our work if we’re not curious enough to seek out our customers’ voice?

In market access, we often treat our asset as our own child and customers’ needs as a stepchild. This backfires on the business as the stepchild always turns out to be the Cinderella of the story.

Isn’t the goal of manufacturers, payers, and providers ultimately the same? To keep patients healthy enough so they stay out of the health care system? It’s just that the market demands each stakeholder to address this call in a different way.

AMCP’s Partnership Forum is a platform where these stakeholders collaborate on tactics and strategies to drive efficiencies and outcomes.

Tapestry Networks is another platform that brings together such stakeholders.

I wonder if there are other such collaborative platforms out there.

Today is the First Day of Your Product’s Life Cycle

Today is the First Day of Your Product's Life Cycle

What a phenomenal shape the circle is.

Where does it begin? Now, where does it end.

Is it possible that the circle could’ve started at any another point?

Yesterday ended last night. Today is the first day of the rest of your product’s life.

70% of launches fail. There’s evidence to suggest that the first year sets the trajectory for the rest of the product’s life cycle.

Cycle = circle.

Even if your drug has already launched, do you get another chance to begin?

How you got here is not how you will get there.

The asset inventory is what it is. It takes months-years to generate new evidence. What will you do in the meantime? Your product already has what it needs to penetrate the market in a way that no other product can–if you allow it.

Take a page from Zig Ziglar’s playbook: If you give them enough of what they want, they will give you everything you want.

Lexus Came From Toyota Embracing Conflicting Goals

Lexus Came From Toyota Embracing Conflicting Goals

If the market demands conflicting outcomes, embrace it (before someone else does).

The market is demanding health care delivery that is affordable + effective—highly conflicting priorities!

Harvard Business Review narrated a successful case of embracing conflicting goals:

‘When designing what became the Lexus line, Ichiro Suzuki, Toyota’s chief engineer, stipulated that the new car needed to be faster, lighter, and more fuel efficient than existing luxury sedans. The order was full of contradictions. Making a car faster usually meant having a bigger, heavier engine; making it lighter without compromising power meant stripping out luxury that was essential for this segment. So, the Lexus team returned to fundamentals and re-evaluated their most basic assumptions about how to build a car. Alongside tens of smaller new ideas, they designed and built a first-of-its-kind aluminum engine that made the car 120 pounds lighter, improving weight and fuel efficiency, thereby delivering on a seemingly impossible demand.’

Right now, all eyes are on payers and PBMs. What are they doing to make health care affordable + effective? Drugs are only effective is they’re used for the right patients at the right time.

Ensure Preapproval Information Exchange (PIE) Is On Time

Ensure Preapproval Information Exchange (PIE) Is On Time

AMCP held an insightful webinar on preapproval information exchange (PIE) in June 2020. I encourage you to check it out.

Lisa Cashman (Director of Clinical Account Services, MedImpact Healthcare Systems), Laura Randa (Vice President Market Access, HEOR and Public Policy, Mycovia Pharmaceuticals), and Jay Jackson (Senior Vice President, Consulting, Xcenda) shared generous insights on payers’ perception of preapproval information exchange (PIE).

Payers want information as early as possible because they might make budgeting decisions a year-out—up to 25% of payers initiate this process 18 months from launch (depending on their plan size). The information they want can broadly be categorized into 3 buckets: volume, patient profile, and cost.

Unfortunately, many PIEs occur too late to be useful for this purpose.

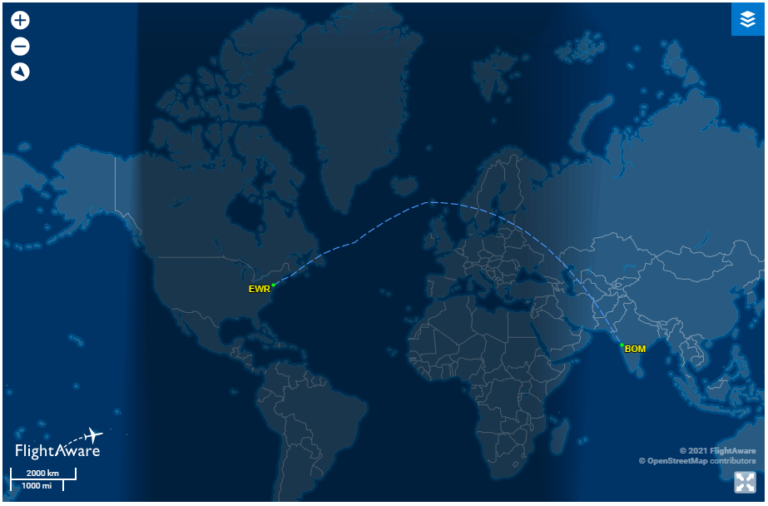

The panelists suggested the following timeline:

- 18-12 months from launch: communicate indication, development plans, preliminary data, epidemiology, and disease information

- 3-6 months from launch: keep the conversation going by providing updates and pricing information (to the extent that you feel comfortable sharing)

- Leading up to launch: begin engaging in health care economic information exchange

Respect Time if you want your investment to work for you.

‘If you’re early, you’re on time. If you’re on time, you’re late. If you’re late, [hopefully you’re not dead. Because if you’re still alive, you get a second chance].’

When do you engage with payers in PIE?

Your Customers Should Feel Heard

Your Customers Should Feel Heard

Everyone has a problem.

Believing that your customers have no problems is just as true as believing that everyone posting smiling photos on Instagram has no problems.

What’s the problem of your customers? What keeps them up at night? What makes it dreadful for them to come back to work the next day? Why are they right to think this way?

The sequel to this would be: How can you show up to delight them? But let’s not get ahead of ourselves.

Customers feeling like they’re heard is in itself a TREMENDOUS stride forward.

Nurture trust. Nurture relationship.

If your neighbor knocked at your door with freshly baked cherry pie, would you accept it? What if a stranger did the same thing: would you accept it?

Keep the ‘Exchange’ in ‘Preapproval Information Exchange’

Keep the ‘Exchange’ in ‘Preapproval Information Exchange’

Preapproval information exchange (PIE) has become among pre-launch strategies since the update to FDAMA 114 in 2018.

Most of us have figured out that it’s important for a launch strategy to include PIE. However, I’m wondering how many of us take FULL advantage of these opportunities to engage with payers pre-launch.

HBR published an interesting article earlier this week suggesting that important consumer insights can be gained from unexpected opportunities like crowdfunding.

Here’s an excerpt: ‘Crowdfunding is not only a source of financing for start-up companies, it’s also a potentially powerful tool for big companies looking for customer input during product development because CUSTOMERS WILLING TO PUT MONEY INTO DEVELOPING A PRODUCT ARE GOING TO BE MORE ENGAGED THAN PEOPLE IN A FOCUS GROUP. Companies that use crowdfunding in this way should pay particular attention to the input of atypical customers.’

Back to PIE: striking a bi-directional conversation during a PIE engagement is key during the pre-approval stage. It’s an important opportunity for manufacturers to get feedback from the customers that will be paying for their assets. This group is possibly more engaged than people in a focus group.

How can your PIE deck be engineered to facilitate a bi-directional EXCHANGE of information rather than a one-way information dump?

Here’s a brilliant recommendation from Nancy Duarte in HBR Guide to Persuasive Presentations:

‘Develop a clear, short overview of your key points, and place it in a set of executive summary slides at the front of the deck; have the rest of your slides serve as an appendix. Follow a 10% rule of thumb: If your appendix is 50 slides, devote about 5 slides to your summary at the beginning. After you present the summary, let the group drive the conversation. Often, executives will want to go deeper on the points that will aid their decision making. You can quickly pull up any slides in the appendix that speak to those points.’

What kind of consumer insights do you want to gain during this preapproval information exchange? How can PIE be used to gain these insights? How will you ensure the feedback gained during the PIE engagements reaches the right people that will act on it?

ICER’s Influence Is Expanding. Now What?

When it comes to US market access, it is common to solicit input from a variety of payer types in order to benchmark an asset’s clinical evidence against payer demands and determine optimal product positioning. However, the Institute for Clinical and Economic Review (ICER) has been making frequent headlines over the past couple of years, raising the question of its degree of influence on market access.

Founded in 2006, ICER calls itself “the nation’s independent watchdog on drug pricing.” The description itself does not settle well with critics of ICER. Craig Garthwaite, a well-published thought leader on the relationship between drug prices and innovation, was interviewed last month by The Incidental Economist. In the interview, Garthwaite noted that “lowering drug spending” is the wrong goal as it can be detrimental to innovation of new medicine. Instead, “The goal of high-value spending is a good goal. With all health care spending, the idea is not that we want to lower spending, the idea is that we want value for money. Even the idea that 18% is ‘too much of GDP to spend on health care’ is a misnomer. The idea is that we want to get the best value we can.” He went on to express, “I don’t believe ICER is as independently beneficial as other people might. I think it has a particular point of view. And I have concerns about an organization that was started with the idea of decreasing costs that says it’s going to come up with an independent view of the value of a product.”

A key function of ICER is to publish reports evaluating whether a drug’s price aligns with the value it offers to patients. Through clinical and economic evidence assessment, ICER researchers arrive at a “value-based price benchmark” for each drug (i.e. a target price range that would achieve incremental cost-effectiveness ratios between $100,000 and $150,000 per QALY gained). Prior to finalization of these reports, ICER solicits feedback and additional evidence from manufacturers, payers, providers, and patients to guide any final revisions. According to Advisory Board, only a third of ICER’s reports have found drugs to be cost effective and fairly priced.

Considering ICER’s bias against drug prices, it makes one concerned of the extent of influence of ICER’s recommendations on payers and reimbursement policies.

ICER’s growing influence has been confirmed by small surveys of payers conducted by independent organizations. A recent survey conducted by ICON in July 2019 and published in November 2019 captured responses from total of 31 respondents from PBMs, MCOs, and IDNs (mostly pharmacy and medical directors). According to the publication, 23% of respondents were extremely familiar with ICER reports, processes, and assessments (up from 18% in the 2018 survey). Forty-two percent had referred to ICER assessments to inform the design of an outcomes-based contract (a sharp increase from 18% just the year before). Other more common utilizations of ICER reports were to provide references for a literature review as part of the drug information/review process (61%), to inform choice of a preferred product(s) within a therapeutic class (58%), to inform prior authorization/step edit criteria (58%), and to use as a negotiation point for rebate/pricing discussions (55%). The publication noted that “While most payers find ICER’s cost-effectiveness useful, they noted that they have not made a ‘hard line’ to set a threshold where coverage will be cut off. Payers leverage ICER reports in the initial assessment phase, and if the drug falls within the cost-effectiveness threshold, payers usually will not take additional steps or add other conditions in determining coverage.”

With the growing influence of ICER, manufacturers have been taking ICER assessments seriously and even participating in the review processes in various ways.

On the conforming end of the spectrum, some manufacturers have provided relevant unpublished data to ICER for analysis and accepted ICER’s value-based benchmark price at launch, as did Sanofi-Regeneron in 2017 with dupilumab.

At the opposite end of the spectrum, manufacturers have generated the required clinical evidence in order to flip ICER’s decision in their favor. In a rare move, ICER reversed its decision on the value of 2 new migraine drugs in February 2020. According to ICER’s Chief Medical Officer, David Rind, “Following the publication of the previous iteration of our report, we worked closely with Allergan to identify high-quality evidence demonstrating additional clinical benefits for ubrogepant beyond the 2-hour time point required by the FDA for the clinical trials. This additional benefit, which likely also applies to rimegepant, supports a near doubling of ICER’s health-benefit price benchmark for these two treatments.”

With conformity on one end and conversion on the other, there are many other ways in between to engage with ICER. Evidera offers suggestions that sound much like the way manufacturers traditionally engage with payers. For example, manufacturers can offer relevant primary and secondary literature which feeds key assumptions for ICER’s economic models. They can also anticipate ICER’s decision and plan for ways of engagement by developing early cost-effectiveness models in-house. Finally, the insights gathered from payers, clinical experts, and patient focus groups can be used to develop approaches to better align product value stories and prepare for pricing negotiations.

Manufacturers should not feel like ICER is cornering them into unfairly reducing prices of their assets. An organization still in its adolescence, ICER is receptive to cross-industry feedback and criticism. It is willing to evolve, as is evidenced by the 2020 Value Assessment Framework which incorporates real-world evidence, creates processes for re-evaluating evidence, and develops a new methodology to evaluate transformative (likely high-cost), curative therapies.

Far from perfect, one of the many flaws that remain to be fixed is that its value-based price benchmarks are determined for patient populations at-large rather than specific subpopulations. The Alliance for Aging Research argues that such an approach discriminates against older adults, people with disabilities, and veterans as they would be deemed ‘too expensive’ to receive care.

As ICER’s role in reimbursement policy is expected to expand, the organization should be viewed as a partner rather than a contender which is both molding and being molded by manufacturers.

It’s time to make big strides and turn heads; let’s go.

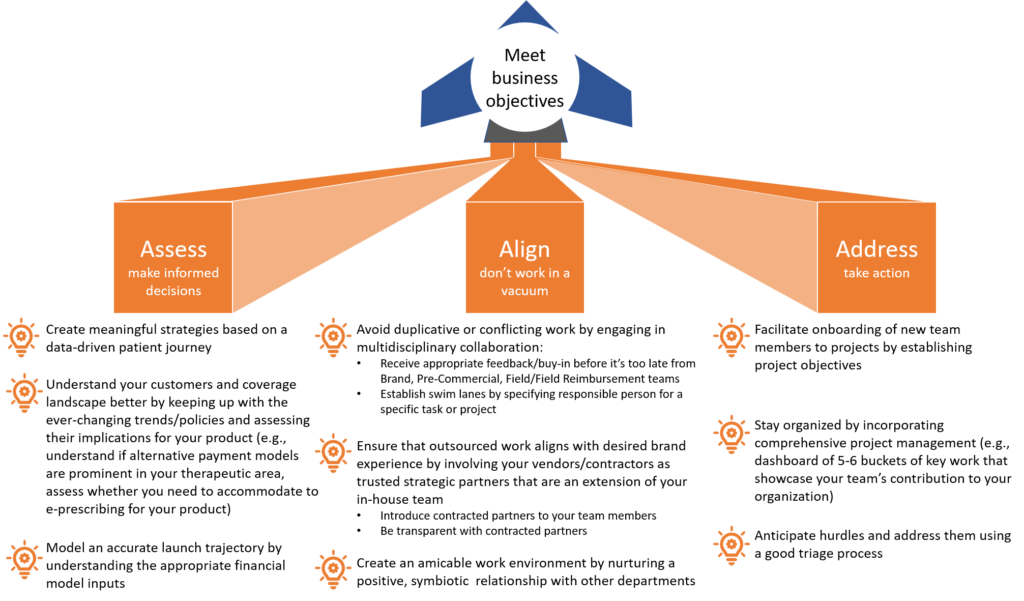

Launch excellence for market access teams: best practices to meet your business objectives

New product launches can be challenging, causing much distress and havoc that could’ve been avoided with the proper insights, planning, and coordination.

Tami Carten, a highly experienced and effective senior leader in market access, offered sage advice for launch best practices at the CBI 7th Annual Reimbursement and Access conference. I believe that operating under her 3-fold execution strategy will enable you to save time, money, and sanity–irrespective of the market landscape and unique product profile. Tami’s strategy ensures the correct mindset and involvement of the right resources to achieve your business goals. After all, there’s a budget for everything, so it’s important not to waste it with meaningless action.

Here, I present a visual rendition to summarize Tami’s strategy for launch excellence. Check against her best practices to make sure you haven’t overlooked something.

It’s time to make big strides and turn heads–let’s go.

Launch excellence: meet business objectives with this 3-fold execution strategy